I Got Two 1099 R Forms Which Do I Use

While your tax return is more complicated as. Payments of reportable death benefits require the use of the 1099-R form for reporting.

One 1099-R you receive will have Code 2early distribution with exceptions in box 7 for the portion of the years benefits prior to turning 59½ and another 1099-R will have Code 7 normal.

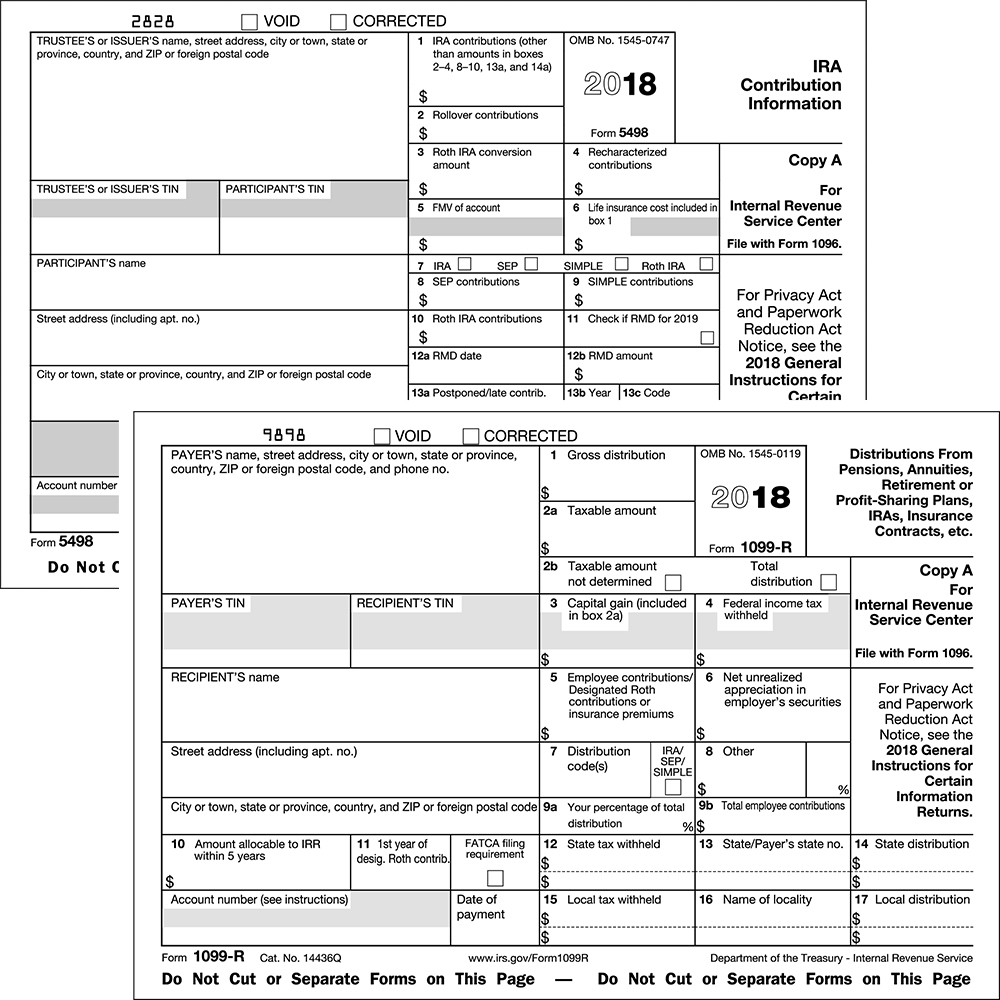

. In the Taxable Amount field enter a -1. If you received a 1099-R for one of the last two reasons listed above another reporting form becomes relevant Form 5498. For most people this gets used to report the distribution as income and include.

If you still dont receive your Forms 1099-R within a reasonable amount of time you. Code 2 - You were under age 59½ as of December 31. A Tax Guide is available for the commonly used Form 1099-DIV Form 1099-B and Form 1099-R Tax FormsDepending on the type of account you hold the funds that you hold your residence the transactions made during the calendar year and other account specific factors you may.

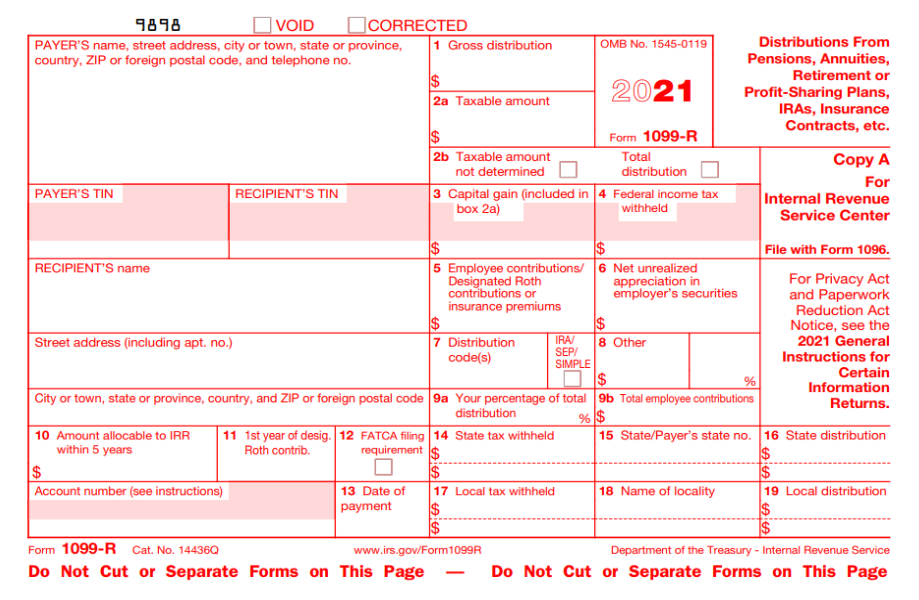

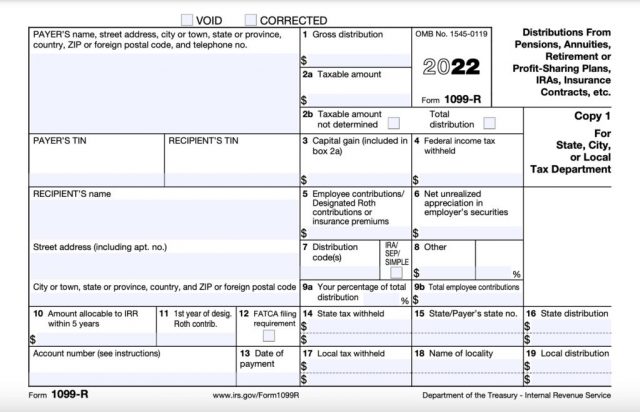

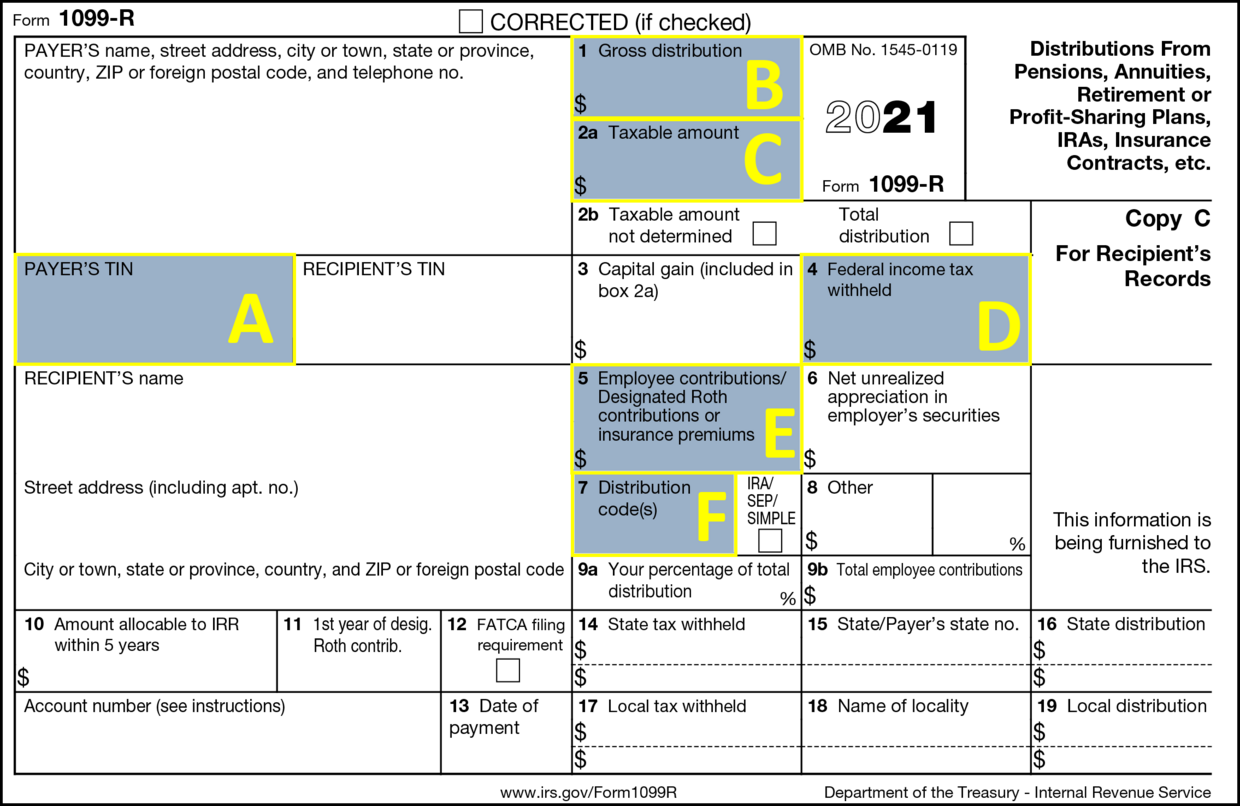

Can I use 1040EZ again. I need to do both. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue.

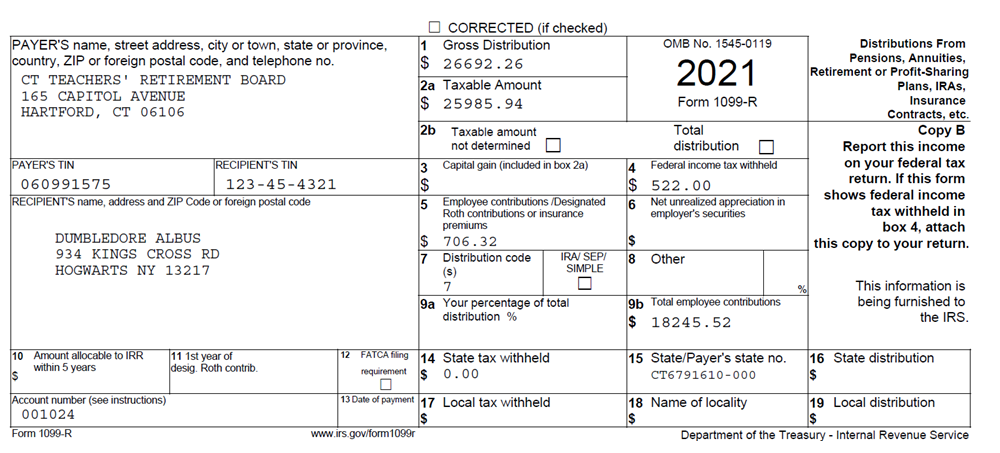

1-800-877-8339 ask to be connected to 800-400-7242 For periodic payments PBGC uses the following codes. We chose to have all three 1099-R distribution incomes spread over three years. This guide explains the information on the form and helps you understand if you should expect to receive more than one 1099-R before filing your 2021 income tax return.

Like Form 1099-R Form 5498 is also filed with the IRS by NDTCO as part of our annual reporting requirements. Youll generally receive one for distributions of 10 or more. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year.

The client took three distributions from three retirement funds - Three 1099-Rs all due to a job loss arising from COVID-19 cutbacks. Then the client started to pay the funds back in 2021. Code 3 - You received a disability pension provided under your.

Variations of Form 1099-R include. Its sent to you no later than January 31 after the calendar year of the retirement account distribution. Annuities pensions insurance contracts survivor income benefit plans.

Most public and private pension plans that are not part of the Civil Service system use the standard Form 1099-R. A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts. You may have reached the age of 59½ at some point during the year.

How do I get my 1099G form online. Form CSA 1099R Form CSF 1099R and. The IRS form 1099-R requires financial institutions to report distributions.

I received 2 1099 R forms from the same investiment company for different amounts. Some of the reasons why you may have been issued two or more 1099-R forms are. The two forms available online are Form 1099-R and Form 1095-B.

If two or more other numeric codes are applicable you must file more than one Form 1099-R. By Michael Pramik Ohio Public Employees Retirement System. There are many varieties including 1099-INT for interest 1099-DIV for dividends 1099-G for tax refunds 1099-R for pensions and 1099-MISC for miscellaneous income.

You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. - Answered by a verified Tax Professional. One for the IRS.

Keep reading to learn about the variety of situations in which someone still working may receive a 1099-R. What tax form am I supposed to use to file my taxes. If the form shows federal income tax withheld in Box 4 attach a copy Copy Bto your tax return.

The 1099-R form is an informational return which means youll use it to report income on your federal tax return. Contact your payers to request your Forms 1099-R. As a contractor with a 1099-MISC however youre responsible for the full 153 of the self-employment tax and you can deduct the one half of the self-employment tax on your personal tax return Form 1040.

If they have sent the forms but you havent received them they might need to resend the forms. As an employee with a W-2 you pay 765 and your employer pays the other 765. To access your Form 1099-G online log into your account at ingov.

Any individual retirement arrangements IRAs. Enter boxes 111 as they appear on the Form 1099-R received. The 403b to IRA irasepsimple box not checked will show zero taxable income incom if the folollowup questions you answered indicated the rollover.

Retirees can use online account to access what they need. My husband got W-2 and 1099-R but we filed with 1040ez online. You will find your Form 1099-G on your Correspondence page.

Sometimes you even receive. 26 2021 Tax season is here and tax forms are available online to OPERS benefit recipients who have registered their OPERS online accounts. But this form is not only applicable to retirees who are drawing down their nest egg.

The transferred will show as double for two transactions. Under the Sections panel choose Form 1099-R. For example if part of a distribution is premature Code 1 and part is not Code 7 file one Form 1099-R for the part to which Code 1 applies and another Form 1099-R for the part to which Code 7.

The 5498 will reflect the results of any rollovers you made to accounts held by us. In the Distribution Code 1 field select code J from the dropdown menu. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from.

Profit-sharing or retirement plans. That happened in tax year 2020 reported last year. We use cookies to give you the best possible experience on our website.

What is a 1099-G form Massachusetts. I received a W-2 and a 1099-R. Request a corrected Form 1099-R by calling PBGCs Customer Contact Center for assistance.

If theres a 10 or more distribution made the issuer must provide the 1099-R form to who received the financial distribution. Depending on the number type and timing of the payments you received from SERS you may receive more than one 1099-R form. Lacerte assumes the two activities arent related.

The Form 1099-R is used to report distributions you may have received from your retirement account IRA annuity pension etc.

Tax Form Focus Irs Form 1099 R Strata Trust Company

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 R 2021 Public Documents 1099 Pro Wiki

What Is A 1099 R Tax Forms For Annuities Pensions

Understanding Your Form 1099 R Msrb Mass Gov

Irs Form 1099 R Box 7 Distribution Codes Ascensus

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

What Is A 1099 R And How To File For Employers Gusto

Understanding Your 1099 R 2021 Tax Year Youtube

American Equity S Tax Form 1099 R For Annuity Distribution

1099 R Software To Create Print E File Irs Form 1099 R

/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

Why Do The Boxes On My 1099 R Form Not Match The

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Form 1099 R Instructions Information Community Tax

Comments

Post a Comment